- CORPGRO Newspoint

- Posts

- ESG and Malus - Docking Deutsche Bank Pay

ESG and Malus - Docking Deutsche Bank Pay

What’s the Story?

This month Deutsche bank reported that it's top executives have been docked €1 million from their bonus pool over “missed milestones“ in fixing internal controls.

Ten executives were hit, with the CEO bonus reduced by €145,000. That lowered the CEO package to €8.9 million, still up 1.4% on the year before.

Deutsche Bank chief’s bonus takes hit from missed governance targets

— Financial Times (@FT)

2:11 PM • Mar 17, 2023

Deutsche bank has been trying to fix poor internal controls such as anti-money laundering controls for five years and at a cost of €2 billion.

BaFin, the regulator, has imposed a special monitor to oversee the needed improvements but signalled last November it was not satisfied with progress, and threatened to fine the bank if crucial deadlines were missed.

The bank also disclosed the majority owned asset manager DWS provided a CEO package of €5.7m. The CEO remained on the payroll after resigning “with effect from the end of 9 June 2022“ - the day following a police raid on the firm’s headquarters, after allegations of overstatement of green credentials from an ex-employee whistle-blower. Other investigations are ongoing by regulators and DWS itself, whose internal review is reportedly nearly complete. The CEO is also the beneficiary of a €8.5 million severance package, some 60% of which is subject to claw-back over the following five years.

Why Does it Matter?

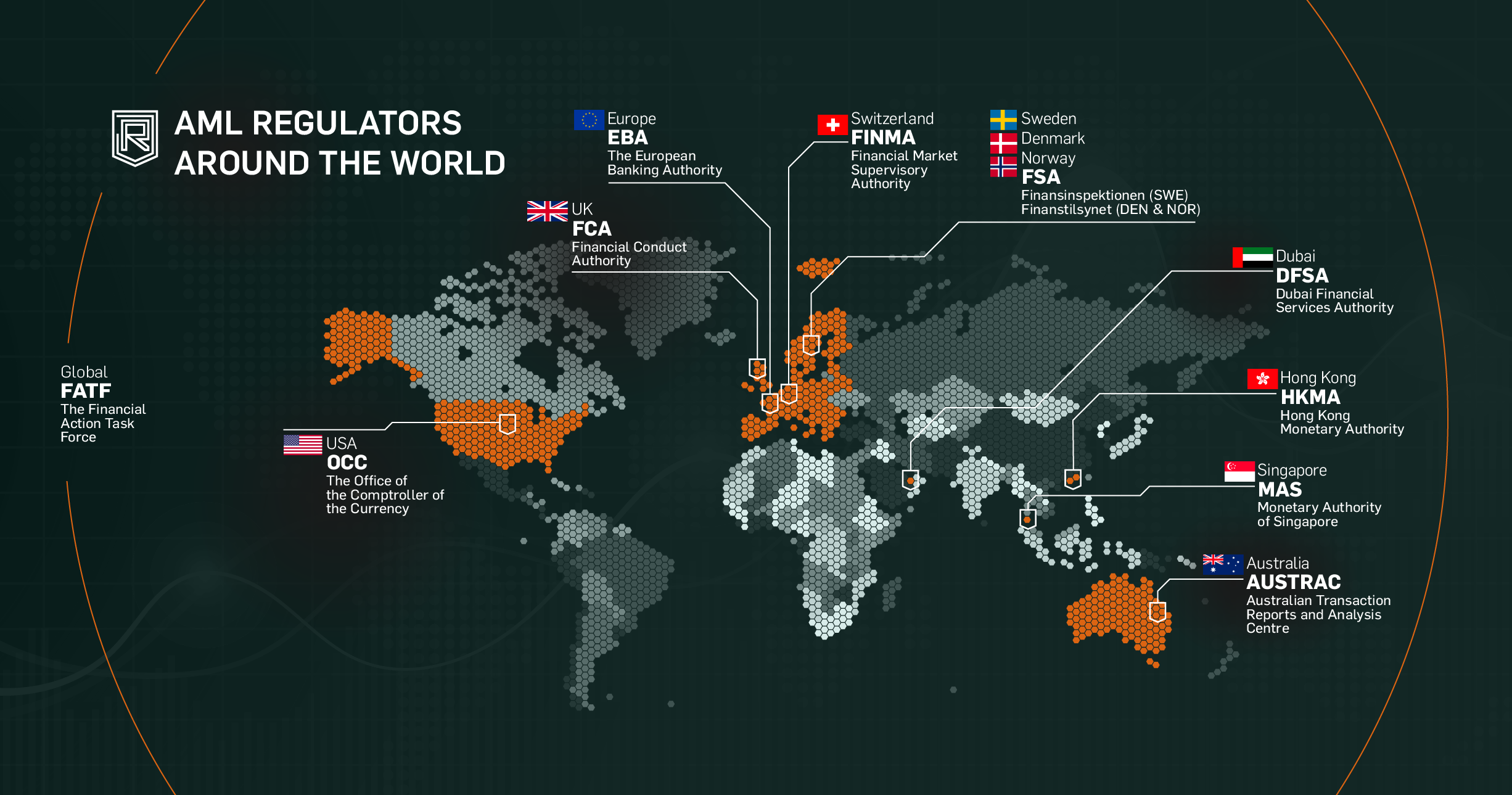

Anti-money laundering laws are not optional, they are a vital tool in the fight against the criminal drug trade, terrorists, people traffickers, those breaching sanctions and similar bad actors. Internal controls are also important to regulate risk-taking, and to ensure customers and clients are protected from mis-selling.

Deutsche bank is a cornerstone within the European financial system. It has ample access to capital and skills and other resources to conduct its business in a compliant manner. The weakness in the bank’s internal controls was identified years ago. The remedial exercise has taken five years, at a cost of €2 billion, and yet the job is still not complete.

The bank’s annual report shows the lender met only 27% of its own targets related to control environments; and only 50% of his anti-money laundering, and know-your-client remediation activities.

The banking system is crucial to the smooth working of global economy. Legal compliance and good risk management are fundamental to any significant banking operation.

In recent weeks, there have been problems at SVB and Credit Suisse. It is therefore very important that bank culture, risk controls and compensation practices mesh smoothly in a compliant and effective way.

Newspoint view

The Deutsche Bank decision to cut top executive bonus amounts, sends a signal of dissatisfaction with progress on delivery of essential system improvements.

A cut in pay of €1m in total, and a CEO cut of only €145,000, is rather minor for such an important failure, over several years and at huge cost.

Internal controls are there to help prevent bad things from happening. The absence of a bad thing actually happening in any one year is not the point. Furthermore, some of these internal controls go beyond risk management for the bank itself, they are a societal obligation.

For a remedial program lasting five years so far, and costing some €2 billion, Deutsche Bank shareholders, and other business partners and also the regulator, have a right to expect strong delivered results.

The banks asset manager, DWS also seems to have some culture and compensation challenges. The alleged overstatement of green credentials is a serious matter with criminal change potential. Why the CEO remained on the payroll after resignation is a mystery. While payments might be subject to clawback, deferral until the internal DWS investigation is complete would seem the more sensible choice.

Bank and FS regulation is not just about capital adequacy, attending to the wider ESG agenda needs a culture of integrity, diligence, fair dealing and social responsibility, combined with compliant and effective executive compensation structures.

CORPGRO Helps Companies With:

Please feel free to email or call:

Damian Carnell - [email protected] +44 (0) 7989 337118

VA Bec Bostock - [email protected]

Please share this CORPGRO information with your board or your colleagues.